Boeing stock has become a hot topic in the investment world, capturing the attention of both seasoned investors and newcomers alike. If you're considering diving into the Boeing stock market, it's crucial to understand the dynamics that drive its performance. From historical trends to future projections, this article will provide you with the insights you need to make informed decisions. Let's break it down step by step so you're not just flying blind into the stock market.

You might be wondering, why should Boeing stock matter to you? Well, Boeing is not just another company; it's a titan in the aerospace industry. Its influence extends beyond commercial aviation into defense and space exploration. Understanding how Boeing stock performs can give you a glimpse into the broader health of the global economy. It's like peeking behind the curtain of the aviation world.

Before we dive deeper, let's set the stage. The stock market can be a wild ride, and Boeing stock is no exception. Over the years, it has seen highs that make you wish you'd bought in sooner and lows that make you question your investment strategy. But don't worry, we're here to guide you through the turbulence and help you navigate the skies of Boeing stock like a pro.

Read also:Hoda Kotb Celebrates Her Daughters Fishing Success A Heartwarming Moment

Understanding Boeing Stock Basics

What Is Boeing Stock All About?

Boeing stock represents ownership in The Boeing Company, one of the largest aerospace and defense corporations in the world. When you buy Boeing stock, you're essentially becoming a part-owner of this massive conglomerate. But what does that mean for you as an investor? It means you're investing in a company that builds planes, defense systems, and even spacecraft. Now that's something to brag about at your next dinner party!

Boeing's stock performance is closely tied to global economic conditions, geopolitical events, and technological advancements. It's like a perfect storm of factors that can either lift your investment to new heights or send it spiraling down. But hey, that's what makes investing exciting, right?

Historical Performance of Boeing Stock

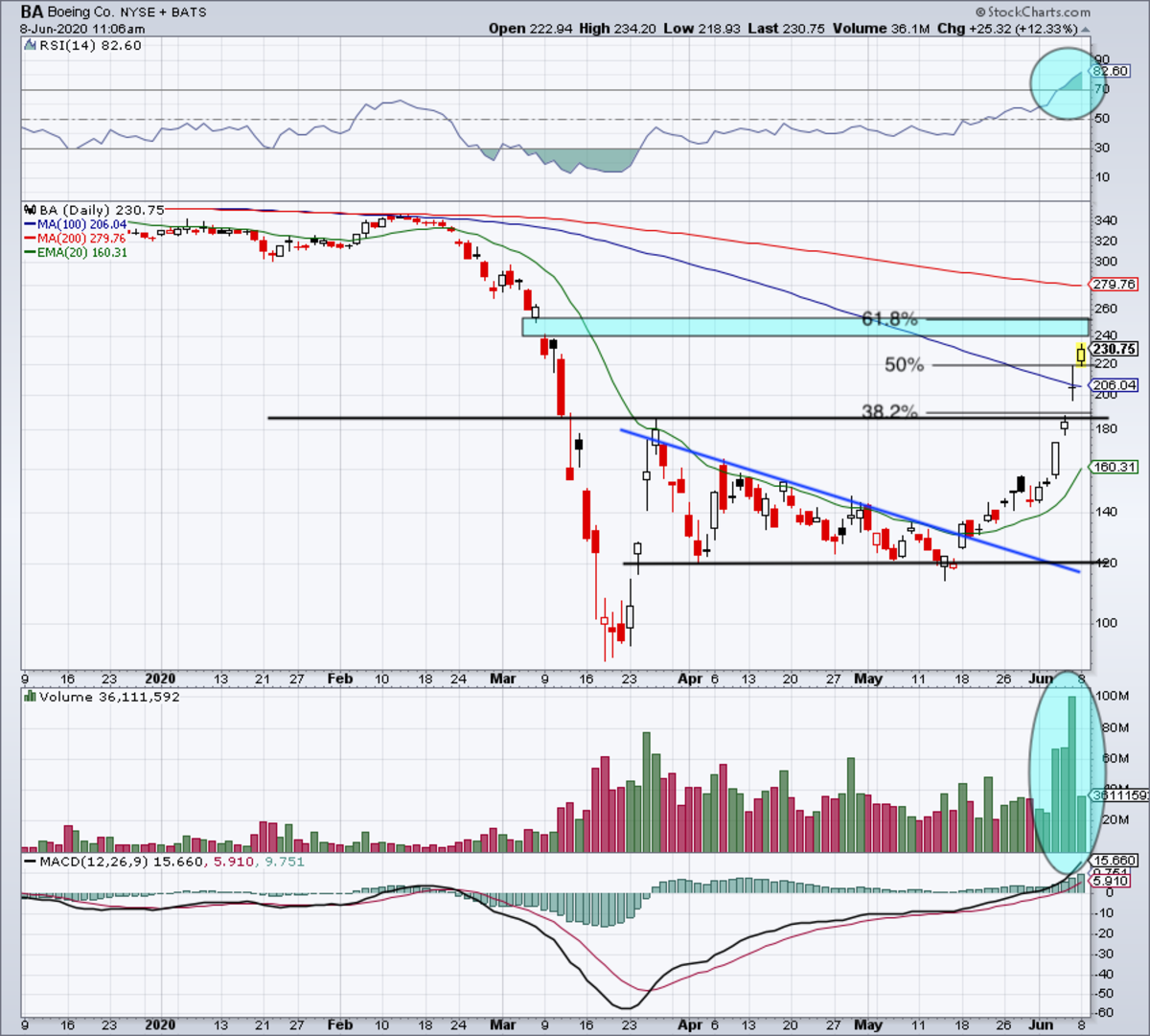

Let's take a trip down memory lane and explore how Boeing stock has performed over the years. Back in the early 2000s, Boeing stock was cruising along nicely, but like any good story, it had its ups and downs. The financial crisis of 2008 hit Boeing stock pretty hard, but it bounced back stronger than ever. By 2017, Boeing stock had reached record highs, making investors smile from ear to ear.

But then came the 737 MAX crisis in 2019, and things took a nosedive. Boeing stock plummeted, and investors were left scratching their heads. However, the company has been working tirelessly to regain its footing, and recent developments show promising signs of recovery. It's like watching a phoenix rise from the ashes, but with a lot more spreadsheets involved.

Factors Influencing Boeing Stock

Global Economic Trends

The global economy plays a significant role in shaping Boeing stock's performance. When the economy is booming, airlines tend to invest in new aircraft, boosting Boeing's sales. Conversely, during economic downturns, airlines may cut back on orders, impacting Boeing's revenue. It's like a seesaw, but with billions of dollars at stake.

For example, during the COVID-19 pandemic, Boeing stock took a hit as air travel demand plummeted. But as the world slowly recovers, so does Boeing's stock price. It's a reminder that patience is a virtue in the world of investing.

Read also:Hugh Jackman And Sutton Foster Love In The Spotlight

Geopolitical Events

Geopolitical events can also have a profound impact on Boeing stock. Trade tensions, international agreements, and political stability all influence the company's operations and profitability. For instance, trade disputes between the U.S. and other countries can affect Boeing's ability to export its aircraft, impacting its stock price.

It's like watching a chess match where every move has consequences. Investors need to keep an eye on global politics to understand how it might affect their Boeing stock investments.

Key Metrics to Watch

Revenue and Earnings

When evaluating Boeing stock, it's essential to look at the company's revenue and earnings. These metrics provide insight into Boeing's financial health and growth potential. Over the years, Boeing has reported impressive revenue figures, driven by its diverse product portfolio.

However, earnings can be a bit more unpredictable. Factors such as production delays, regulatory issues, and unexpected expenses can impact Boeing's bottom line. It's like trying to predict the weather; sometimes it's sunny, and sometimes it rains.

Dividend Yields

Another factor to consider is Boeing's dividend yield. For income-focused investors, dividends can be an attractive feature of Boeing stock. While Boeing has a history of paying dividends, it's important to note that these payments can fluctuate based on the company's financial performance.

Think of dividends as a little extra pocket money. They may not make you rich overnight, but they can add up over time, especially if you reinvest them.

Investment Strategies for Boeing Stock

Long-Term vs. Short-Term Investing

When it comes to Boeing stock, deciding between long-term and short-term investing depends on your goals and risk tolerance. Long-term investors focus on the company's fundamentals and growth potential, while short-term traders look for quick gains based on market fluctuations.

For those with a long-term mindset, Boeing's history of innovation and market leadership can be compelling reasons to hold onto the stock. On the other hand, short-term traders might capitalize on news events or market trends to make quick profits. It's like choosing between a marathon and a sprint.

Diversification and Risk Management

Diversification is key to managing risk in your investment portfolio. While Boeing stock can be a valuable addition, it's wise to spread your investments across different sectors and asset classes. This way, if one stock takes a hit, others can help cushion the blow.

Risk management also involves setting clear goals and limits. Know how much you're willing to invest and what your exit strategy is. It's like having a map when you're on a road trip; it helps you stay on track and avoid getting lost.

Market Analysis and Predictions

Analyst Ratings and Forecasts

Analysts play a crucial role in shaping investor sentiment towards Boeing stock. Their ratings and forecasts can influence buying and selling decisions. Currently, many analysts are bullish on Boeing stock, citing its recovery efforts and strategic initiatives as positive indicators.

However, it's important to take analyst opinions with a grain of salt. They may have their own biases and agendas. Always do your own research and make informed decisions based on the data available to you.

Future Growth Potential

Looking ahead, Boeing stock has several growth opportunities. The company is investing heavily in new technologies, such as sustainable aviation fuels and electric aircraft. These innovations could position Boeing as a leader in the future of aviation.

Additionally, the global demand for air travel is expected to increase as the world continues to recover from the pandemic. This could drive up demand for Boeing's aircraft, boosting its stock price. It's like watching a sunrise; the future looks bright.

Challenges Facing Boeing Stock

Regulatory and Safety Concerns

One of the biggest challenges facing Boeing stock is regulatory and safety concerns. The 737 MAX crisis highlighted the importance of safety in the aviation industry. Boeing has been working to address these issues and restore public trust, but it's an ongoing process.

Regulatory compliance can also be a double-edged sword. While it ensures safety, it can also add costs and delays to production. Investors need to be aware of these challenges and how they might impact Boeing's stock performance.

Competition in the Aerospace Industry

Boeing is not the only player in the aerospace industry. Companies like Airbus and Lockheed Martin are fierce competitors. The competition drives innovation, but it can also put pressure on Boeing's market share and profitability.

Investors should keep an eye on Boeing's competitive landscape and how the company plans to maintain its edge. It's like a high-stakes game of chess, where every move matters.

Data and Statistics

Boeing Stock Performance Over the Last Decade

- In 2013, Boeing stock reached $100 per share for the first time.

- By 2017, the stock price had surged to over $300 per share.

- The 737 MAX crisis in 2019 caused a significant drop, with the stock price falling below $400.

- As of 2023, Boeing stock has shown signs of recovery, trading around $200 per share.

These figures highlight the volatility of Boeing stock and the importance of staying informed about market trends.

Market Share and Revenue Figures

- Boeing accounts for approximately 40% of the global commercial aircraft market share.

- In 2022, Boeing reported revenue of $66.6 billion, up from $54.4 billion in 2021.

- The company aims to increase its production rates to meet growing demand, which could boost revenue further.

These statistics demonstrate Boeing's significant presence in the aerospace industry and its potential for future growth.

Sources and References

For further reading, consider checking out the following sources:

These resources provide valuable insights into Boeing's operations, financial performance, and industry trends.

Conclusion

Boeing stock offers a fascinating glimpse into the world of aerospace investing. While it comes with its share of challenges, the opportunities for growth and innovation are undeniable. By understanding the factors that influence Boeing stock and staying informed about market trends, you can make smarter investment decisions.

So, what are you waiting for? Dive into the world of Boeing stock and see where it takes you. Remember to share your thoughts in the comments below and explore other articles on our site for more investment insights. Happy investing, and may your portfolio soar to new heights!

Table of Contents

- Understanding Boeing Stock Basics

- Factors Influencing Boeing Stock

- Key Metrics to Watch

- Investment Strategies for Boeing Stock

- Market Analysis and Predictions

- Challenges Facing Boeing Stock

- Data and Statistics

- Sources and References

- Conclusion