Listen up, folks. We’ve all been there—waiting anxiously for that sweet tax refund check to hit our bank accounts. But what happens when the IRS messes up and blocks your $11k refund? Yeah, it’s a nightmare, but guess what? You’re not alone. This issue has been popping up more than ever lately, and it’s time we break it down so you know exactly what’s going on and how to handle it.

Now, let’s be real here. Tax season can feel like a rollercoaster ride, especially when things don’t go as planned. Whether it’s a simple mistake or something more complicated, the IRS error blocking refunds is becoming a major concern for taxpayers across the country. And trust me, nobody wants to deal with this headache, especially when you’re counting on that money for bills, vacations, or just general life expenses.

But hey, before you panic, let’s dive into the details. Understanding why the IRS blocks refunds and how to fix the issue can save you a ton of stress. So grab your favorite drink, sit back, and let’s unravel the mystery behind the IRS error that’s costing people thousands of dollars. Let’s get started!

Read also:Jensen Ackles Shares Exciting Update On Amazon Primes Countdown

What is an IRS Error Blocking $11k Tax Refund?

So, what exactly does it mean when the IRS blocks your tax refund? Simply put, it’s when the IRS flags your return due to suspected errors, discrepancies, or potential fraud. In some cases, it could be as simple as a typo in your Social Security number or bank account details. But other times, it might involve bigger issues like identity theft or incorrect tax calculations.

For many taxpayers, the frustration kicks in when they realize their $11k refund is being held up because of an error they didn’t even know existed. It’s like getting stuck in traffic on the way to a concert—you know the destination is awesome, but the journey is pure torture.

Common Reasons for IRS Errors

Here’s a quick rundown of the most common reasons why the IRS might block your refund:

- Incorrect Information: A typo in your Social Security number, bank account details, or filing status can cause the IRS to flag your return.

- Identity Theft: Unfortunately, fraudsters are always looking for ways to steal your identity and claim your refund. If the IRS detects suspicious activity, they’ll put a hold on your return.

- Mathematical Errors: Even if you’re using tax software, mistakes can still happen. Double-check your numbers before submitting your return.

- Outstanding Debts: The IRS might offset your refund to pay off outstanding federal or state debts, such as unpaid child support or student loans.

And let’s not forget about the infamous IRS backlog. With millions of returns to process each year, delays are inevitable. But don’t worry—we’ll cover how to speed things up later.

How Does the IRS Error Impact Taxpayers?

When the IRS blocks your $11k tax refund, it’s not just about the money—it’s about the impact it has on your financial well-being. Many people rely on their refunds to pay bills, cover medical expenses, or even take a much-needed vacation. So when the IRS holds up your refund, it can throw a major wrench in your plans.

Imagine this: You’ve been saving up for months to finally take that trip to Hawaii. You’ve booked your flights, reserved your hotel, and planned every detail. But then, boom—the IRS blocks your refund, leaving you high and dry. It’s enough to make anyone lose their cool.

Read also:Tracy Morgan Opens Up After Health Scare At Knicks Game

Financial Stress and Anxiety

Let’s face it—money problems can cause a lot of stress and anxiety. When the IRS blocks your refund, it’s easy to feel overwhelmed and unsure of what to do next. Some people might even start questioning their own financial decisions or worry about how they’ll make ends meet.

But here’s the thing: You’re not powerless. There are steps you can take to resolve the issue and get your refund back on track. So instead of stressing out, let’s focus on finding a solution.

Steps to Fix the IRS Error

Alright, so you’ve discovered that the IRS has blocked your $11k refund. Now what? Here’s a step-by-step guide to help you fix the issue and get your money back where it belongs—your pocket.

Contact the IRS Immediately

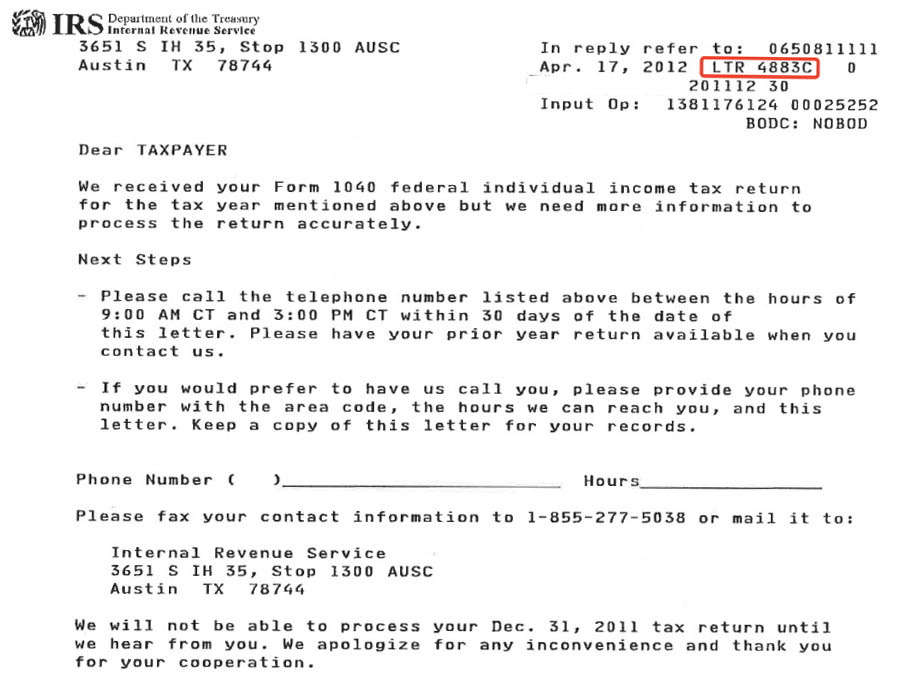

The first thing you should do is contact the IRS. They have a dedicated team to handle refund inquiries, and they can provide you with more information about why your refund was blocked. Be prepared to provide your Social Security number, filing status, and the date you filed your return.

You can reach the IRS at 1-800-829-1040 or visit their website for more information. Trust me, it’s better to address the issue head-on rather than waiting for it to resolve itself.

Check for Errors in Your Return

Next, take a close look at your tax return to see if there are any errors. Double-check your Social Security number, bank account details, and filing status. If you used tax software, review the forms to ensure everything was filled out correctly.

If you spot any mistakes, you’ll need to file an amended return using Form 1040-X. It’s a bit of a hassle, but it’s worth it to get your refund back on track.

Understanding IRS Processing Times

One of the biggest complaints taxpayers have is the lengthy processing times at the IRS. With millions of returns to process each year, delays are pretty much guaranteed. But how long should you expect to wait for your refund?

According to the IRS, most refunds are issued within 21 days of receiving your return. However, if your refund is flagged for review, it could take several weeks—or even months—to resolve the issue. And if the IRS needs to verify your identity or investigate potential fraud, the wait time can stretch on indefinitely.

How to Speed Up the Process

While you can’t control the IRS processing times, there are a few things you can do to speed things up:

- File Electronically: E-filing is much faster than mailing in your return. Plus, you’ll receive a confirmation that your return was accepted.

- Use Direct Deposit: Instead of waiting for a paper check, opt for direct deposit to get your refund faster.

- Avoid Common Mistakes: Double-check your return for errors before submitting it. The fewer mistakes you make, the smoother the process will be.

And if you’re still waiting on your refund, you can check the status using the IRS’s “Where’s My Refund?” tool. Just enter your Social Security number, filing status, and refund amount to get an estimated timeline.

IRS Error Prevention Tips

Prevention is key when it comes to avoiding IRS errors. By taking a few simple steps, you can reduce the likelihood of your refund being blocked in the first place. Here are some tips to keep in mind:

Double-Check Your Information

Before submitting your return, take the time to double-check all the information you’ve entered. A single typo can cause the IRS to flag your return, so pay close attention to details like your Social Security number, bank account details, and filing status.

Use Reputable Tax Software

Tax software can be a lifesaver when it comes to avoiding errors. Programs like TurboTax and H&R Block offer built-in checks to catch mistakes before you submit your return. Plus, they’ll guide you through the process step-by-step, making it easier to file accurately.

Protect Yourself from Identity Theft

Identity theft is a growing concern, especially during tax season. To protect yourself, use strong passwords, enable two-factor authentication, and monitor your credit reports regularly. If you suspect identity theft, report it to the IRS immediately.

IRS Error Statistics and Trends

According to recent data, the IRS processed over 160 million tax returns in 2022. While the majority of refunds were issued without issue, a significant number were flagged for review due to suspected errors or fraud. In fact, the IRS reported a 20% increase in refund delays compared to the previous year.

So what does this mean for taxpayers? Simply put, the IRS is cracking down on errors and fraud more than ever before. While this is good news for preventing scams, it also means more delays for innocent taxpayers who are just trying to get their refunds.

How to Stay Informed

Staying informed about IRS trends and updates can help you avoid common pitfalls. Follow the IRS website and social media channels for the latest news and tips. You can also sign up for email alerts to stay up-to-date on important deadlines and changes.

Real-Life Stories: IRS Error Horror Stories

Let’s hear from some real people who’ve experienced IRS errors firsthand. These stories might sound extreme, but they’re all too common in the world of tax refunds.

Case Study 1: John’s Missing Refund

John filed his tax return back in February, expecting his $11k refund to hit his account by mid-March. But when the weeks turned into months, he started to worry. After contacting the IRS, he discovered that his refund had been flagged due to a suspected identity theft issue. It took over six months to resolve the issue, but John finally got his refund—just in time for Christmas.

Case Study 2: Sarah’s Typo Nightmare

Sarah accidentally entered the wrong bank account number on her tax return, causing her refund to be sent to the wrong account. By the time she realized the mistake, it was too late—the funds had already been deposited and withdrawn. After months of back-and-forth with the IRS, Sarah was finally able to recover her refund, but not without a lot of frustration and stress.

Conclusion: Take Action Today

So there you have it—the lowdown on IRS errors and how to fix them. Whether you’re dealing with a simple typo or something more serious like identity theft, the key is to stay calm and take action. By following the steps outlined in this article, you can resolve the issue and get your $11k refund back where it belongs.

And remember, you’re not alone in this. Millions of taxpayers face similar issues every year, and the IRS is there to help. Don’t hesitate to reach out if you need assistance—it’s their job to make sure you get the refund you deserve.

So what are you waiting for? Check your refund status, review your return, and take the necessary steps to fix any errors. And if you found this article helpful, don’t forget to share it with your friends and family. Together, we can make tax season a little less stressful.