Let’s talk about the elephant in the room—Trump’s budget plan. It’s been a hot topic since it hit the headlines, and for good reason. The Trump budget proposal has sparked debates nationwide, with critics claiming it heavily favors the rich while leaving the poor hanging. But what’s the real deal? Is this budget plan really aiding the wealthy at the expense of the less fortunate? Let’s dive in and break it down for you.

Imagine this: you’re sitting at the dinner table, and someone decides to slice the pie unevenly. While one group gets a massive portion, the other is left with crumbs. That’s essentially what critics are saying about the Trump budget. It’s not just about numbers; it’s about who benefits the most from these financial decisions.

Now, before we get into the nitty-gritty, let’s establish one thing: this isn’t just another political rant. We’re here to give you the facts, the stats, and the real-world implications of the Trump budget. So buckle up, because we’re about to take a deep dive into how this plan might affect everyone—from the top 1% to the working class.

Read also:The Secret To Better Sleep Might Be On Your Plate

Understanding the Trump Budget: What’s the Deal?

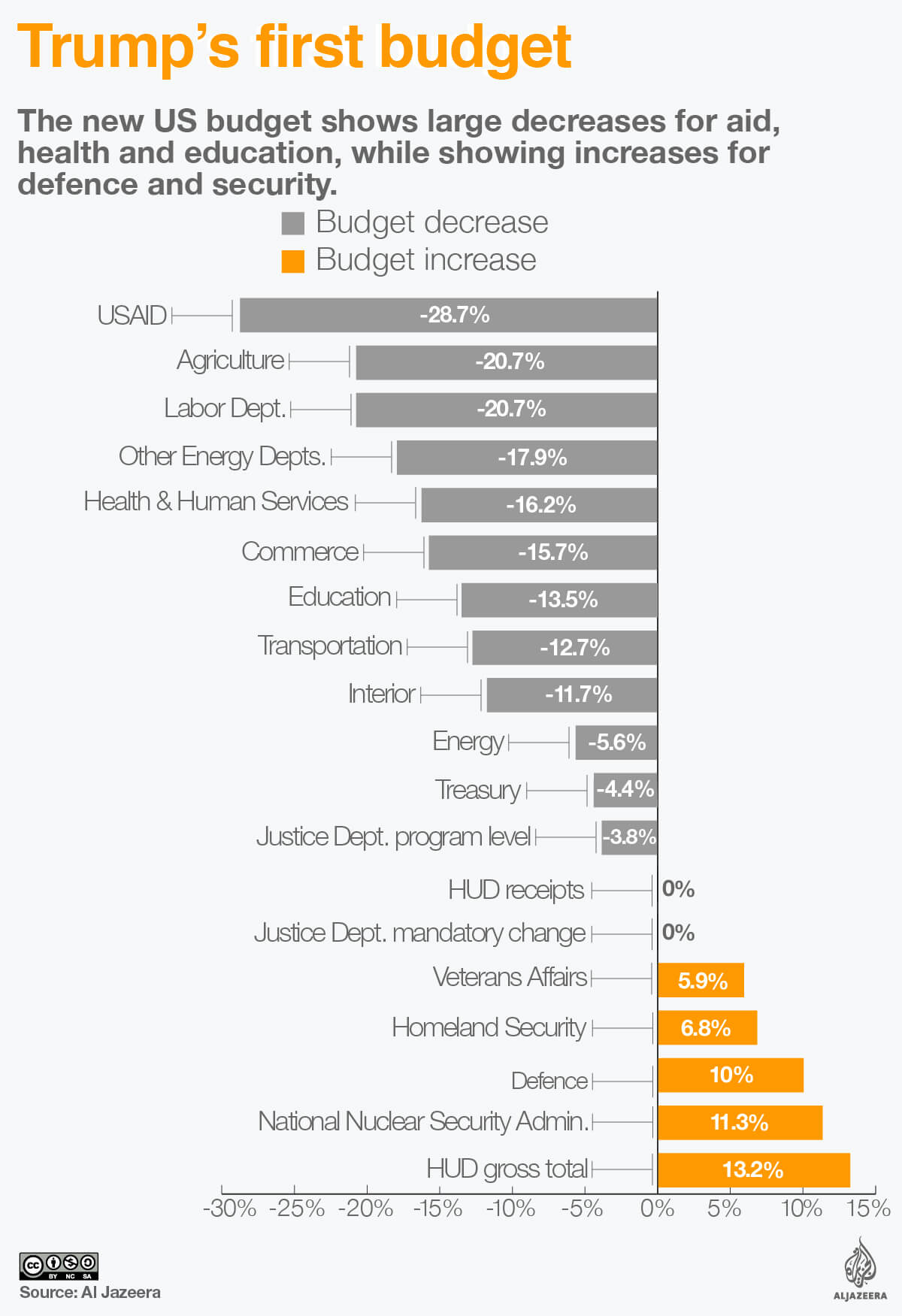

First things first, let’s break down what the Trump budget actually entails. Announced during his administration, this budget proposal aimed to reshape federal spending priorities. While some praised it as a move towards fiscal responsibility, others criticized it for widening the wealth gap. Here’s the gist:

- Cuts to social programs like Medicaid, food stamps, and housing assistance.

- Tax cuts primarily benefiting high-income earners and corporations.

- Increased military spending and investments in infrastructure.

Now, here’s the kicker: the budget proposal suggests cutting billions from programs that support the poor while simultaneously offering tax breaks to the wealthy. Sounds a bit off, right? Let’s explore why this has sparked so much controversy.

Who Benefits the Most? Breaking Down the Numbers

When you look at the numbers, the picture becomes clearer. According to reports from reputable sources like the Congressional Budget Office (CBO), the tax cuts proposed by Trump disproportionately benefit the wealthiest Americans. Here’s a quick snapshot:

- The top 1% could see an average tax cut of over $100,000 per year.

- Meanwhile, middle-class families might only see a few hundred dollars in savings.

- Programs like SNAP (Supplemental Nutrition Assistance Program) face significant cuts, potentially affecting millions of low-income families.

It’s not just about the numbers; it’s about the people behind them. These cuts could mean fewer resources for those who rely on government assistance to make ends meet. On the flip side, the wealthy might see their bank accounts swell even further.

The Wealth Gap: Is Trump’s Budget Making It Worse?

One of the biggest criticisms of the Trump budget is that it exacerbates the wealth gap. The rich get richer, and the poor get poorer—or at least that’s the narrative. But is it true? Let’s examine the evidence.

According to a report by the Institute on Taxation and Economic Policy (ITEP), the proposed tax cuts would primarily benefit the top 20% of income earners. Meanwhile, the bottom 20% would see minimal benefits, if any. This widening disparity has raised concerns about economic inequality and its long-term effects on society.

Read also:George Gray Files For Divorce A Closer Look At His Journey And Relationship

How Does the Wealth Gap Affect Everyone?

It’s not just about the rich and the poor; the wealth gap affects everyone. When the gap widens, it can lead to:

- Increased social tensions and unrest.

- Higher poverty rates and more people relying on government assistance.

- Reduced economic mobility, making it harder for people to climb the income ladder.

These are issues that impact the entire nation, not just specific groups. So when we talk about the Trump budget, we’re talking about more than just numbers—we’re talking about the future of economic equality in America.

What About the Poor? How Are They Affected?

Now, let’s zoom in on the other side of the equation: the poor. Critics argue that the Trump budget disproportionately hurts low-income Americans by cutting vital programs. Here’s how:

- Medicaid cuts could leave millions without access to affordable healthcare.

- Reductions in housing assistance might force families into precarious living situations.

- Food stamp cuts could leave vulnerable populations struggling to put meals on the table.

These programs are lifelines for many Americans. Without them, the already difficult circumstances faced by low-income families could become even more challenging. It’s a tough pill to swallow, especially when the wealthy are reaping the rewards of tax cuts.

The Human Impact: Real Stories

To truly understand the impact of the Trump budget, let’s look at some real-life examples. Meet Sarah, a single mother of two who relies on Medicaid for healthcare. If the proposed cuts go through, she might lose access to essential services. Then there’s John, a factory worker who depends on food stamps to feed his family. With cuts to these programs, his situation could become dire.

These aren’t just statistics; they’re people with real lives and real struggles. The Trump budget proposal raises questions about whether it prioritizes the needs of all Americans—or just a select few.

The Rich Get Richer: Tax Cuts and Corporate Benefits

On the flip side, let’s talk about the winners in this budget proposal: the rich. The tax cuts outlined in the Trump budget would provide significant benefits to high-income earners and corporations. Here’s a breakdown:

- Lower corporate tax rates, boosting profits for big businesses.

- Reductions in individual tax rates for the wealthiest Americans.

- Potential increases in investment opportunities for the affluent.

While these changes might sound great for the wealthy, they raise concerns about fairness and equity. Should the rich receive such substantial benefits while the poor face cuts to essential programs? It’s a question that continues to fuel the debate.

Is the Trump Budget Fiscally Responsible?

Proponents of the Trump budget argue that it’s a step towards fiscal responsibility. By cutting spending and reducing the national debt, they claim it will benefit the country in the long run. But is that really the case?

According to the CBO, the proposed tax cuts could actually increase the deficit in the short term. While cutting social programs might reduce spending, the loss of revenue from tax cuts could offset those savings. It’s a delicate balancing act, and critics argue that the Trump budget doesn’t strike the right balance.

What About Long-Term Effects?

The long-term effects of the Trump budget remain uncertain. While some predict economic growth driven by tax cuts and increased investment, others warn of potential consequences:

- Rising inequality could lead to social and economic instability.

- Cuts to social programs might increase poverty rates and strain public resources.

- Increased debt could burden future generations with higher taxes or reduced services.

These are risks that need to be carefully considered when evaluating the Trump budget’s impact on the nation’s fiscal health.

Public Reaction: What Are People Saying?

As with any major policy proposal, the Trump budget has sparked a wide range of reactions. Here’s a look at what people are saying:

- Supporters argue that it promotes economic growth and reduces government waste.

- Opponents claim it favors the rich and neglects the needs of the poor.

- Some experts warn of potential long-term consequences for the economy and society.

The debate is ongoing, and opinions vary widely depending on political affiliations and personal perspectives. But one thing is clear: the Trump budget has ignited a national conversation about economic priorities and fairness.

Expert Opinions: What Do the Numbers Say?

Let’s turn to the experts for their take on the Trump budget. Economists and policy analysts have weighed in with differing opinions:

- Some believe the tax cuts will stimulate growth and create jobs.

- Others warn of the risks associated with rising inequality and budget deficits.

- Many emphasize the need for a balanced approach that addresses the needs of all Americans.

These expert insights provide valuable context for understanding the potential impact of the Trump budget on the nation’s economy and society.

Conclusion: Where Do We Go From Here?

So, what have we learned about the Trump budget? It’s a complex proposal with far-reaching implications. While it offers benefits to the wealthy through tax cuts and corporate incentives, it also raises concerns about the impact on low-income Americans and the widening wealth gap.

As the debate continues, it’s crucial to consider the long-term effects of these financial decisions. Will the Trump budget lead to economic growth and prosperity for all, or will it deepen the divide between the rich and the poor? Only time will tell.

What can you do? Stay informed, engage in the conversation, and make your voice heard. Whether you agree or disagree with the Trump budget, your participation in the democratic process is more important than ever. Share this article, leave a comment, and let’s keep the dialogue going. Together, we can shape the future of America’s economic priorities.

Table of Contents

- Understanding the Trump Budget: What’s the Deal?

- Who Benefits the Most? Breaking Down the Numbers

- The Wealth Gap: Is Trump’s Budget Making It Worse?

- What About the Poor? How Are They Affected?

- The Rich Get Richer: Tax Cuts and Corporate Benefits

- Is the Trump Budget Fiscally Responsible?

- Public Reaction: What Are People Saying?

- Conclusion: Where Do We Go From Here?